By: Muhammad Moin Lakhiar

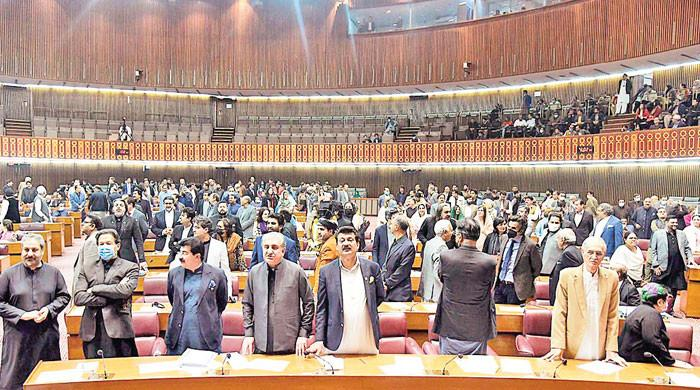

Of the more than 150 lawmakers who have imposed taxes on the people, including two federal ministers, have not paid any taxes on their huge income and wealth, and many of them have not even registered with the FBR. Being and yet being protected from any kind of legal action against oneself by the concerned institutions and authorities shows the extent to which corruption has reached the state system. According to a recent report by Geo News, 161 out of 1170 members of the Houses of Parliament have not paid any tax on their income and have not submitted their tax returns while the total value of their assets is Rs 35 billion. Numerous MPs who have bought properties worth millions of dollars in Dubai, Norway and London are not active taxpayers. Dozens of them have their own construction companies and petrol pumps. Of the nearly three dozen non-paying MPs, each has assets worth about Rs 100 million, while a dozen own assets worth Rs 500 million. The names of 30 women MPs are not listed in the FBR. Unfortunately everyone is naked in this bath, PTI, Noon League, PPP, MQM, JWP, BAP, ANP, Jamaat-e-Islami, JUI, MMA and PK map all. ‘S affiliates are involved in tax evasion. And these are the members who do not pay taxes at all. If those who hide the real income and reduce the tax due as much as possible are included in it, then hardly anyone would be considered pious. With this book of deeds, there is no moral justification for demanding full tax from ordinary citizens. The perpetrators of this behavior do not fulfill the condition of being honest and trustworthy as per Article 62 of the Constitution. Therefore, Members of Parliament should avoid tax evasion in any way.